Tax bills are on the way

Sheriff points out new

look of property tax bills

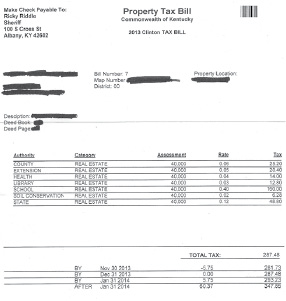

Clinton County property tax bills will be mailed out next week and according to the Clinton County Sheriff’s office, they will have a new look.

Now property owners in Clinton County won’t receive the yellow tax notice in the mail, but will however be seeing a tax bill printed out on a normal sized sheet of paper with the tax information on it.

Property taxes due, along with where to mail those payment will be listed on the tax bill, as well as the property location and the address of the tax payer.

The Sheriff’s Department wanted to notify the public of the change in format in order for taxpayers to identify the bill and pay it on time to prevent any penalties from being assessed.

If you do not receive your bill in the next few days, please contact the Sheriff’s Department at 606-387-5111. When mailing your payment, include your copy of the tax bill or put the bill number on your check. If you wish to have a paid receipt returned to you, enclose a self-addressed, stamped envelope.

The collection dates are as follows: two percent discount if paid by November 30, 2013; face value from December 1 through December 31, 2013; five percent penalty from January 1 though January 31, 2014 and a 10 percent penality February 1 through tax sale date.

Payments made during the 10 percent penalty period, but prior to the delinquent tax claim sale, are subject to an additional 10 percent sheriff’s fee. In addition to the 10 percent penalty, payment made after April 15, 2014 are subject to a 20 percent county attorney’s fee and a 10 percent clerk’s fee.

If you have a change of address, contact the sheriff’s department or the Property Valuation Administrator’s office.